These offsets have a document type AE and other information similar to the A/R offset. The Posting Journal also lists the automatic offsets for VAT. The explanation for other types of entries includes the tenant name and the description of the bill code.

The batch number replaces the character string XXXXXXXX. It is usually Post Offset by Batch /XXXXXXXX for automatic entries related to A/P batches. If the constant is D or S, the number is the invoice number or voucher number.Įxplanation - For automatic entries (document type AE) related to A/R batches, the explanation is usually Post Offset by Batch 2XXXXXXXX.

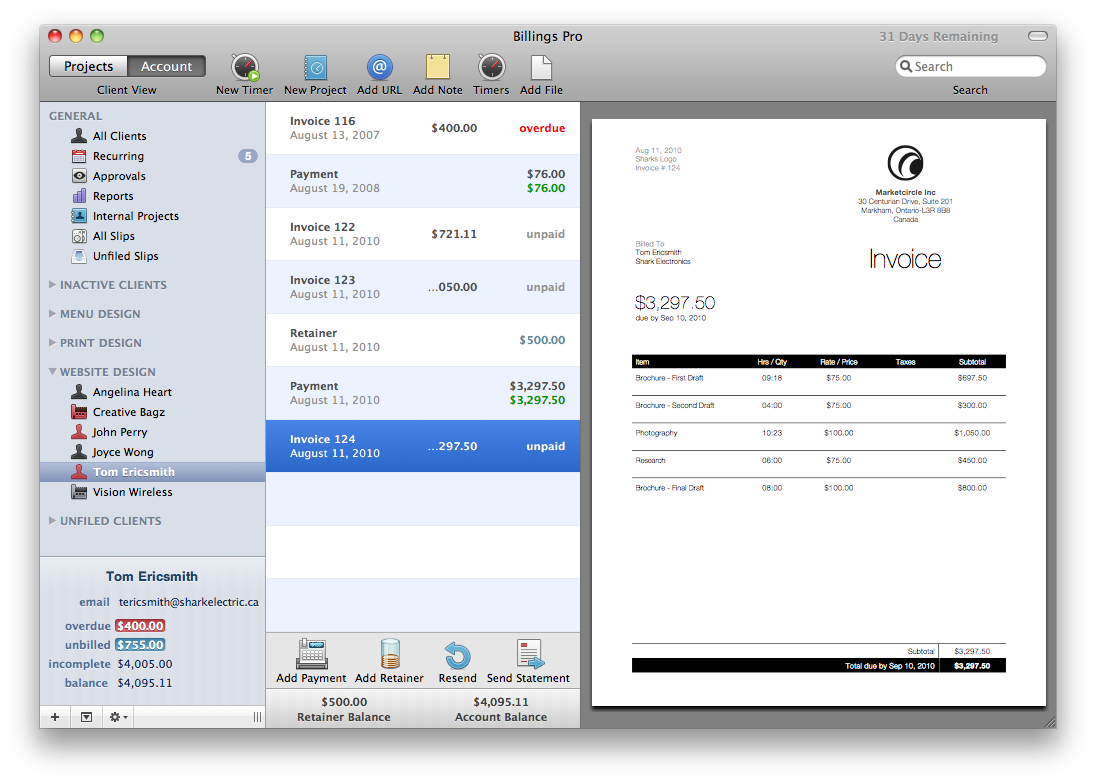

Bulk invoicing in billings pro manual#

A/P document types are PQ for manual billings, PF for recurring billings, and AE for automatic entries.ĭocument number - If the A/R or A/P constant for the offset method is B, the document number is the same as the batch number assigned to the document. A processing option controls whether the system prints the Posting Journal.įor batches that do not post because of balancing problems, the Detail Post Error report lists the detail transactions, which you can use to identify the problem.ĭescription of "Figure 19-2 Posting Journal"ĭocument type - A/R document types are RN for manual billings, RD for recurring billings, and AE for automatic entries. Prints one of the two following reports depending on the final posting status of the batch:įor batches that post, the Posting Journal lists the transactions posted to the G/L Account Balances and Account Ledger files. A processing option controls whether the system updates this file.

Updates the Sales/Use/VAT Tax file (F0018). Performs intercompany settlements, if requested, for ledger type AA only. The posted codes in the three files are P, D, and D, respectively.Ĭreates the automatic offsets to either A/R or A/P. Marks the transactions as posted in the following files:Įither the A/R Account Ledger (F0311) or A/P Account Ledger file (F0411) Posts the transactions to the G/L Account Balances file (F0902). Gets the automatic offset method, summary by batch, summary within a document, or detail by document from the General Constants file (F0009).Ĭollects and posts the automatic offset amounts for the invoices.

The system displays the Post Invoices screen with a list of processing options.ĭifferent versions of the post program are also available on other menus in the Real Estate Management system.ĭuring the post, the system performs the following tasks for any batches that have completed the pre-post without an error: After creating the transactions, the system begins the posting process.įrom the Real Estate Management System menu (G15), choose Manual Billing.įrom the Manual Billing menu (G1512), choose Post Invoices.

At this time, it also marks the documents as posted in the Tenant/Lease Billings Detail file. When you submit documents for posting, the system runs a DREAM Writer version of the G/L Transaction Generation program (P15199), which creates the A/R, A/P, and G/L transactions. Prior to posting, all the A/R invoices and A/P vouchers are placed in the Tenant/Lease Billings Detail file (F1511). This chapter describes the posting process for invoices and vouchers and how it creates the automatic offset entries to the general ledger. The Real Estate Management system has its own version of the posting program. Section 19.2, "Post Invoices Procedures,"

0 kommentar(er)

0 kommentar(er)